By Fiona Fitzsimons

The Valuation Office Archives have an unparalleled coverage of 100% of all households in rural districts, falling to 65% in urban parishes, with evidence on living conditions, housing, employment, land tenure and land ownership. These records are the backbone of family and local history research in nineteenth- and twentieth-century Ireland.

The Valuation Office was established in 1826 to create a more equitable property tax to fund the new Poor Law. The first task was to complete a standard survey of all property: land, buildings and the managed landscape—brickfields, quarries, riverbeds used as fisheries, estuaries with oyster-beds, and osier beds to grow willows for coppicing.

Between 1830 and 1865 the Valuation Office, directed by Richard Griffith, undertook a series of surveys to investigate who owned property, who occupied it and what wealth it could produce annually. The surveys captured a huge amount of evidence and organised it by subject and place in a standardised book format. Each survey had its own set of books, which survive today as Field, House, Quarto, Tenure and Mill Books.

Field Books, completed by parish and county between 1830 and 1852, recorded who owned the land, the size of the holding, the quality of the land and land use. Unfortunately they don’t name the occupiers (i.e. those who worked the land). Nevertheless, the information sets the template, important for understanding later surveys.

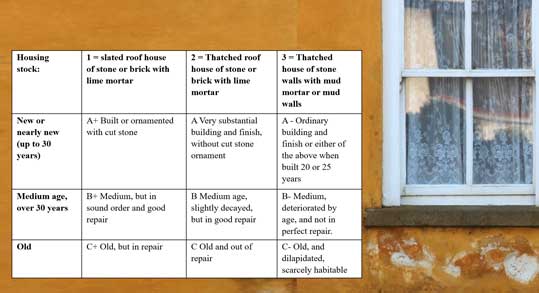

House Books, completed by townland, parish and county between 1833 and 1861, included the dimensions of every house (with its outbuildings and any cultivable land); the building materials used—from mud (cob) and rubble to brick and cut stone, mortar made of mud or lime, a slate or thatch roof; the age and state of repair; and the names of all householders.

Quarto Books, completed between 1838 and 1853, calculated the value of houses in an urban setting.

Tenure Books, completed by parish between 1846 and 1859, recorded the names of tenants and lessors, a description of the holding, the type of tenure (by lease, annual tenancy or tenancy-at-will), rents paid (including after 1844 the rent-by-labour arrangement made by cottiers), and the names of occupiers and lessors. They are an invaluable source for tracing almost every household in Ireland, before, during and after the Famine. They are sometimes referred to as ‘Perambulation Books’, as the surveyors ‘walked the boundaries’ to confirm them.

Mill Books, completed by townland, parish and county between 1831 and 1851, surveyed mills, the only industrial buildings given their own series of books, reflecting their importance in the local economy.

The different surveys were carried out in parallel, often overlapping. By the mid-1840s the work had progressed to the point where they could be used for their end-purpose—to calculate the new property tax. The Valuation Office ‘filleted’ the different surveys to produce the Primary Valuation, or ‘Griffith’s Valuation’, published between 1847 and 1864, which ushered in the new property tax—‘rates’—that paid for the Poor Law system.

The Valuation Office Archives are available at https://www.nationalarchives.ie/article/valuation-office-records/ and www.findmypast.com.

Fiona Fitzsimons is a director of Eneclann, a Trinity campus company, and of findmypast Ireland.